Excerpt:

Monday, November 30, 2020

Brexit and Fishing Rights

Sunday, November 29, 2020

Saudi & UAE on Joint Digital Currency Plan

Excerpt:

"In a joint statement the Central Bank of the United Arab Emirates (CBUAE) and the Saudi Central Bank (SAMA) launched the ‘Aber’ project, which seeks to evaluate the feasibility of issuing a digital currency for use between the two central banks."

Saturday, November 28, 2020

Friday, November 27, 2020

Thursday, November 26, 2020

Pricing Mechanism of Sukuk

Good introductory article on Sukuk below.

https://ideas.repec.org/a/bor/bistre/v19y2019is1p21-33.html

Wednesday, November 25, 2020

Move over V, U, W and L

I borrow the first sentence of the article below on K-shaped economic recovery. Happy reading.

Tuesday, November 24, 2020

Case Studies in Islamic Banking and Finance

A Series of Cases written by Brian Kettel. There are a few on Sukuk.

Source: Internet

Monday, November 23, 2020

State of the Global Islamic Economy Report 2019/2020

You can read the Report here. The 2020/2021 Report is also available.

https://www.salaamgateway.com/specialcoverage/SGIE19-20

Excerpt from 2020/2021 Report:

Sunday, November 22, 2020

Zillenials and C-Generation (Covid Generation)

You will love this article, especially if you run you own business. Farsighted review.

Excerpt:

"Investment implications could include, according to BofA:

Consumer-driven sustainable activism could lead to risks for “harmful” sectors like fast fashion

InkleWriter - Online Interactive Story

Interesting sharing by Prof. Karim and Dr. Nurliyana on Inklewriter. Try it. Loads of fun.

https://www.youtube.com/watch?v=cZ4AO-6zeyg

Friday, November 20, 2020

Covid-19 Up-Ending Capitalism

Here is one good article summarising the winners and losers of the war against Covid-19. Similar article appears earlier in May 2020. Many big companies are helping out, for example producing hand sanitizers and distributing them for free. The society's moral compass is at work.

Excerpt:Read more at https://www.todayonline.com/commentary/covid-19-upending-capitalism-we-know-it-can-businesses-rewrite-their-rule-books

https://www.economist.com/the-world-ahead/2020/11/17/covid-19-is-up-ending-capitalism

Thursday, November 19, 2020

3D Printing the New Normal in Manufacturing

A friend alerted me to the economics of 3D printing.

https://www.bernama.com/en/thoughts/news.php?id=1850376

Wednesday, November 18, 2020

Tuesday, November 17, 2020

Lending Lifeline

Recent article in the IMF Blog (16 Nov.) addressing urgent financing needs during the pandemic. One word we keep hearing. UNPRECEDENTED.

https://blogs.imf.org/2020/11/16/imf-lending-lifeline-addressing-urgent-financing-needs-brought-on-by-the-pandemic/Kudos to the Illustrator.

Monday, November 16, 2020

Another Look at CBDC (Central Bank Digital Currency)

The article is written on Nov. 15, 2020. Quite Cryptocurrency-centric. The audio is also available (5.09 minutes).

https://cointelegraph.com/news/central-bank-digital-currencies-are-dead-in-the-waterSunday, November 15, 2020

The Best Economics Book of 2019

The Covid-19 Recession of 2020 by Prof. Mankiw

Writing by Prof. Mankiw highlighting the supply and demand side of the twin crises, forthcoming in Macroeconomics, 11e. You can visit his blog.

https://scholar.harvard.edu/files/mankiw/files/covid-19_recession_of_2020_aug2020.pdf

Friday, November 13, 2020

Ant's, IPO and Digital Yuan

An Interesting article for the weekend reading. I have posted a link a=on Ant Financial before this.

https://www.coindesk.com/how-ants-suspended-ipo-is-related-to-chinas-digital-yuan

Thursday, November 12, 2020

The Impact of COVID-19 on Inflation

An article in IMF Blog.

Excerpt:

https://blogs.imf.org/2020/11/10/data-disruption-the-impact-of-covid-19-on-inflation-measurement/

Wednesday, November 11, 2020

What Your Voice is Saying About You

Remember the round voice of James Earl Jones? Let's do a vocal audit.

https://www.fastcompany.com/40417930/four-ways-to-tell-what-your-voice-is-saying-about-you

The English Wars - New Yorker

Tuesday, November 10, 2020

The Money Flower - Digital Currency

Sunday, November 8, 2020

Biden and the World

As seen by the CNN's article. Excerpt below:

Saturday, November 7, 2020

Biden and US Foreign Policy

Friday, November 6, 2020

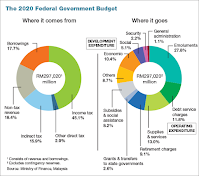

Analysis on Malaysia's Budget 2021

The Budget was tabled on 6 Nov. 2020 by the Finance Minister. The largest expenditure in history.

Below is the link to the past 10 years comparison. Debt:GDP ratio is 60.7% in 2020. Fiscal deficit is 6% in 2020 and Government plan to reduce it to 5.4% in 2021. Let's hope the economy will be recovering soon, the debt will be smaller and deficit is reduced to 5%.

https://newslab.malaysiakini.com/budget2021/en/infographic

Thursday, November 5, 2020

Chinese Yuan and Reserve Currency Status

Will Yuan replace USD in international trade? Some says yes, some says no. Time will tell.

Excerpt from Another Source:

Wednesday, November 4, 2020

Malaysia Budget 2021 from Deloitte Malaysia

You can download the one-page Q&A pre-budget expectations from Deloitte Malaysia here. Mostly about tax-relief. And yes, they are expecting GST comeback.

Let's wait for Budget Announcement on Nov. 6, 2020 at 4 pm.

https://www2.deloitte.com/my/en/pages/tax/articles/malaysia-pre-budget-2021-qa.html

Tuesday, November 3, 2020

California Prop. 22, the younger brother of AB 5

The majority of gig workers in the United States are voting against Prop 22 per the Election 2020, claiming the 'future of labor' at stake. You can watch the short video below and read the story at the given link.

https://techcrunch.com/2020/10/16/human-capital-prop-22-puts-the-future-of-labor-at-stake/

Monday, November 2, 2020

Harapan Belanjawan 2021

A short article on SMEs, especially OYO and the downstream industries (in Malay). Good suggestions, especially the "Laluan Hijau." However, it would be better if the author include where the sources of money should come from.

https://www.bernama.com/bm/tintaminda/news.php?id=1893303

Sunday, November 1, 2020

IIFM Sukuk Report

The latest version is available.

Global Growth

Heightened trade tensions and policy uncertainty will drive global growth down this year to its slowest pace since 2008, according to the W...

-

In Tinta Minda, BERNAMA. Malay article. Excerpt: "Laporan prestasi ekonomi negara pada suku ketiga pada 2020 yang diumumkan Bank Negara...

-

How are you going to contribute to the nations in terms of closing the wealth inequality gap?

-

Please read the article by Paul Krugman in the New York Times at the link given below and give your comments as what Malaysia had experience...