It has been quite some time since I last wrote on my fav topic of Sukuk. At the beginning of coronavirus pandemic, European government was proposing Pandemic bond. Somehow the Pandemic bond issuance was dwarfed by the falling oil prices and the digital currency of Renminbi. Perhaps I didn't catch the news.

Anyway, here is an article on Sukuk. The article summarises the global shocks as follows:

"... many jurisdictions are facing an unprecedented combination of challenges, including health issues, reduced oil revenues, economic disruption, severe financial market dislocation and changes in liquidity and investor sentiment."

Sukuk market is almost at standstill during March 2020, due to the same reasons. However, the market is expected to pick-up post-COVID19 due to financial stimulus packages undertaken by many governments.

There is also a short mentioned of LIBOR and SOFR. I wish the article elaborate more on the issue. I wrote on this issue in iECONS2019 Conference. I include here some visuals on latest trends. There are many more available. Graphics are the language of the netizens. It is amazing how Big Data nowcasting information. Reading is the key.

Pic. Sukuk Currency Issuance. My Fav Topic. USD is still King. Maybe Sukuk should try eRMB?

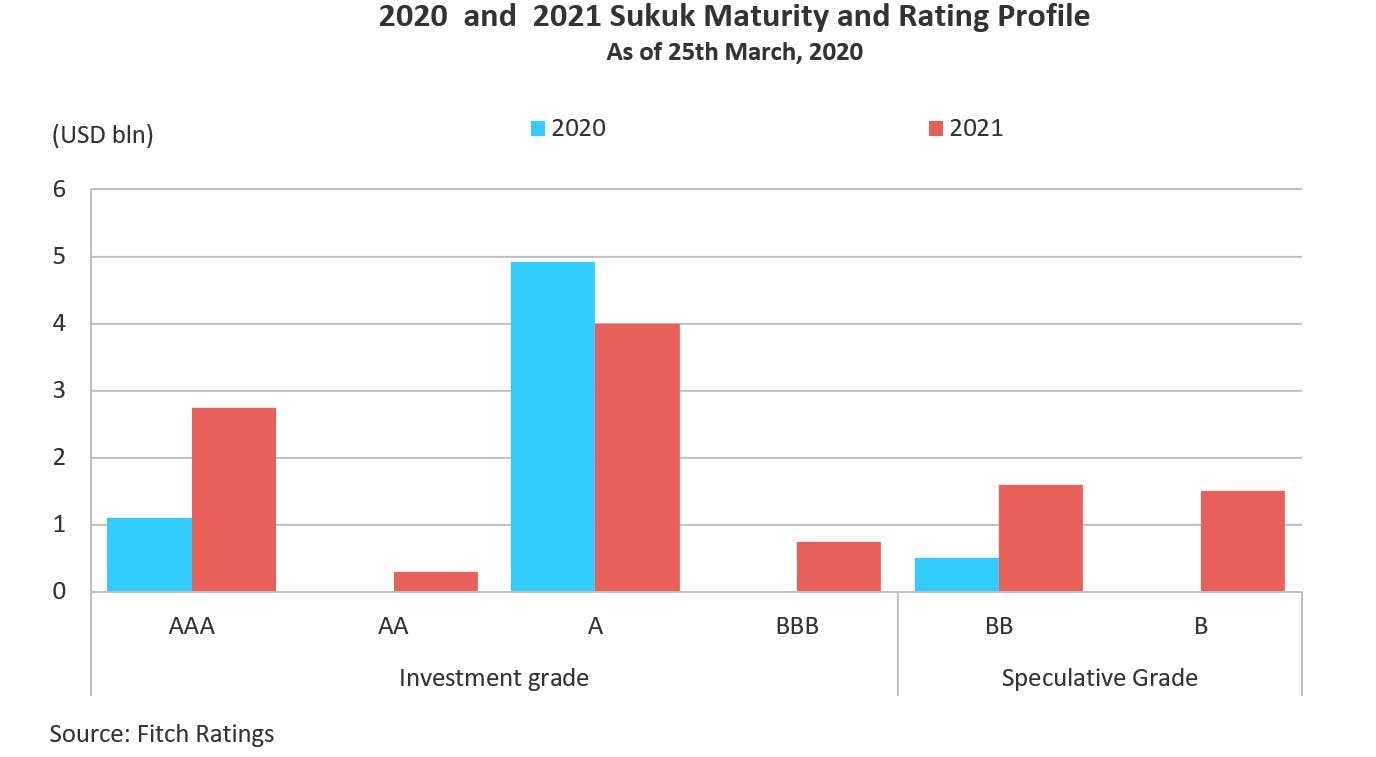

Pic. Sukuk Currency Issuance. My Fav Topic. USD is still King. Maybe Sukuk should try eRMB? Pic. Latest Sukuk Profile

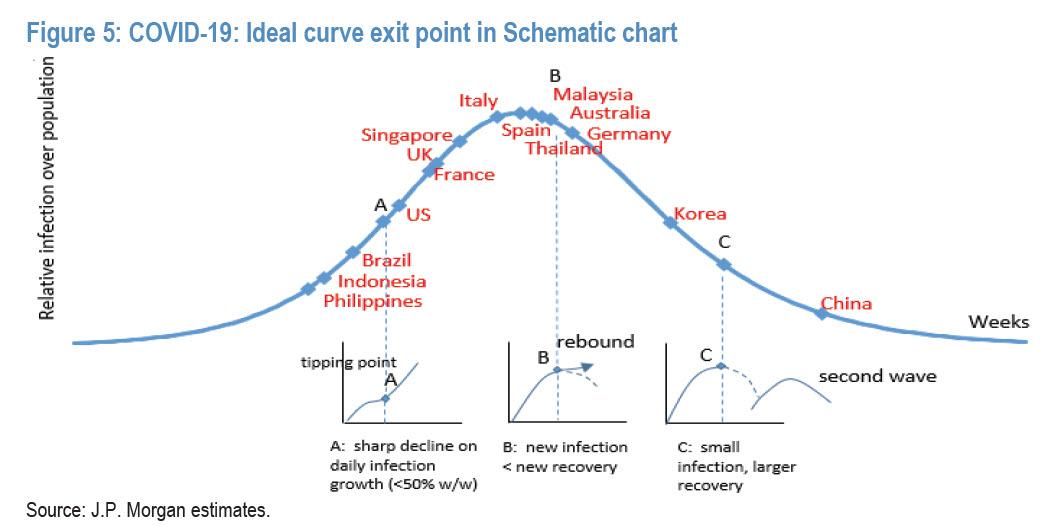

Pic. Latest Sukuk Profile Pic. Can't Resist the Bell-Curve Creative Explanation.

Pic. Can't Resist the Bell-Curve Creative Explanation.

I think the oil prices went under subzero because the demand for oil is decreasing during the lockdown or restricted management order. So, although the demand is decreasing, the supply of the oil is still higher and it has lead to a decreasing in the oil price. There also an issue which is some country has produced more oil and it affected the world's oil price because there was a surplus for the oil. So, all of the issue has make the oil price went under subzero.

ReplyDelete