More on the oil prices story today. Is this the tip of the iceberg? Is the world ready for another shock? This time, the oil industry is hit by both demand and supply side. Demand falls due to the lockdown of corona-virus. Supply halted because of Arab Saudi-Russia oil prices tug-of-war.

In economics we learn about subnormal profit. Now, we have to learn about subzero prices. What a great bookmark in history. Good for learning. Good for recapitulating. Good for future recovery process. Good for knowledge.

Nature finally took over and said: "Hey, give me some space. The Earth is suffocating right now. Step aside for a while. Stay at Home, Man. Let other Species Roam the Earth."

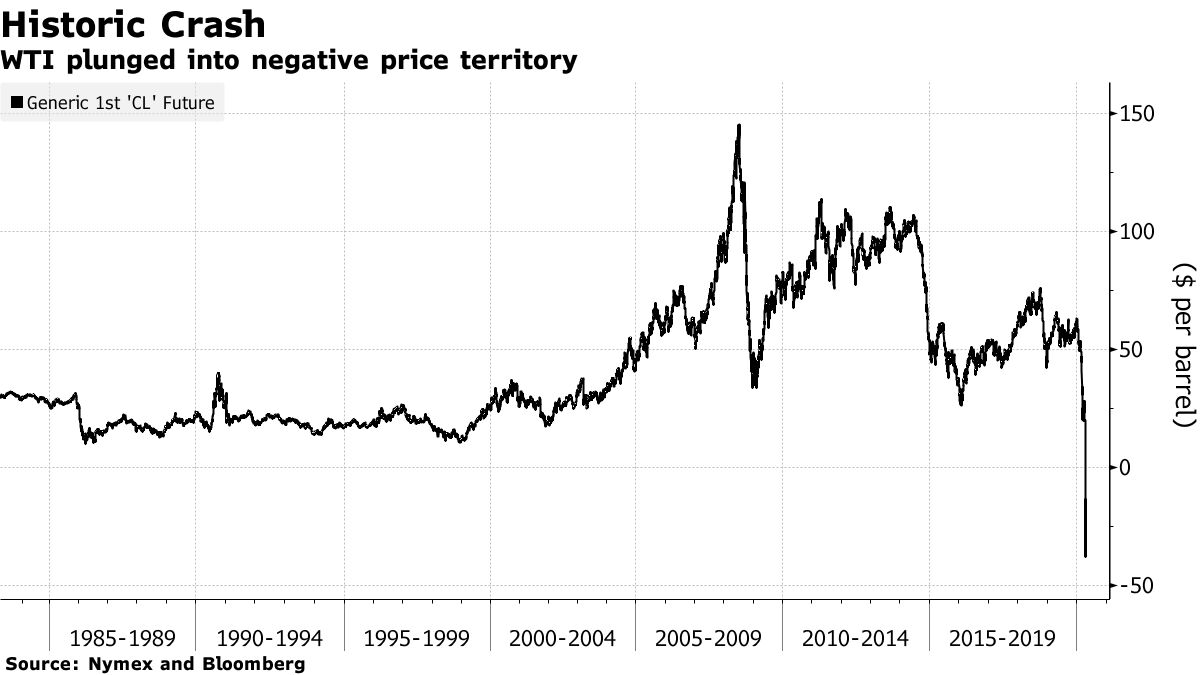

The Subzero oil prices story here. Pic. From Bloomberg. Historic Negative Plunge.

Pic. From Bloomberg. Historic Negative Plunge.

Global oil demand has been affected by COVID-19 and many countries have decided to restrict any travel, and many of us choose not to travel anywhere. The outbreaks have slowed the world economy and reduced transportation use indirectly this has also reduced demand for oil. The fall in oil prices may be good for consumers, but the impact on the government is the opposite as it will further reduce government revenue.

ReplyDeleteAgree with you last statement.

DeleteIn my opinion, maybe in the future, we don't use oil anymore to run a car and we must think another way to run a car with cheaper price and can still stable the economy growth. It is because we can learn from this situation about when Covid-19 spread, people don't use a car daily like always and prefer to stay at home. So the demand for oil is lower than usual and the supply is over the demand.

ReplyDeleteIf you want, you can write a short article and publish your opinion in Tinta Minda - Bernama. You can search for the link in my other post.

DeleteIn our opinion, me and Izzatil Iman, global oil prices have dropped but the West Texas Intermediate (WTI) fell sharply by the end of April by 306% turning oil prices to $-37.63. One of the reasons WTI is falling is that crude oil is being traded through future contracts and WTI is physical delivery and as most countries lockdown so the demand for oil decreases but the Brent oil price remains positive despite falling 9.82% and it's roll over.

ReplyDeleteOil prices in 2020 have been affected by COVID-19. Oil prices are also expected to remain weak for a long time. This is because efforts to curb the spread of COVID-19 have caused global economic activity to disrupt and cause oil demand to decline. In fact, oil prices are expected to continue to decline due to uncertainty condition. However, oil prices rises may occur after there are signs of stability in the COVID-19 outbreak numbers.

ReplyDeleteThis comment has been removed by the author.

DeleteFrom the data provided, all variables are continuous numerical variables by which the oil market price is measured. If the world oil prices is taken as a population, I take Malaysian oil prices as a sample. So, I have been analysing oil prices data for the past 30 weeks. This shows that simple random samples are selected as types of sample.

DeleteAfter looking at the oil price on the world market, I look at the latest weekly prices for RON95, RON97 and Diesel (categorical variables) from other websites. Then, I put all the prices in each category for 30 weeks in a table to organize the data. After recording all the oil prices, I need to visualise the data in a chart to represent the data of each week. With the polygon chart, I can see changes in oil prices that are said went to subzero.

According to the chart, general analysis can be made for oil prices in Malaysia in the last 30 weeks. In general, Malaysian oil prices have shown similar prices and have not changed in the 1st week to 19th week (October 2019 to January 2020) where no major economic crises have occured. But from the 20th to the 23rd week (February 2020), oil prices for each category showed fluctuates. However, it only lasts for four weeks and starts falling from the 24th week to the 30th week (March 2020 to April 2020). Now, oil prices in Malaysia have dropped from week to week just like world oil prices.

In summary, the price of oil in Malaysia will decline due to current trends in global oil market. Berita Harian reported a decline in global crude as a result of price war between Saudi Arabia and Russia and a shock reduction in demand following global movement restrictions to curb the COVID-19 pandemic. These factors put pressure on oil prices to keep trading low. And also gave impact to cutting global demand by up 33% and excess supply of discounted oil.

Thanks for the thorough reply. Hope you keep reading on oil prices and benefit from the argument.

DeleteIn my opinion, the oil prices sank below zero is something unusual but it does happen in this time due to low demand because of the COVID-19 pandemic and the price war between Saudi Arabia and Russia. Somehow it will take a long time to recover and for it to return normal. If we want to relate with the normal distribution, the price of oil data would have fall real far from the mean making it standard deviation to increase. To overcome this situation, the country which their main business activity is oil exporting might have to figure out another way to utilize their access of supply and innovate new product using oil that can be much more useful during this pandemic.

ReplyDeleteLeft-skewed or right-skewed? You have found a good/real life/recent example of normal distribution.

DeleteThe crash of the WTI oil price on Monday illustrated in part the short-sightedness of certain market participants over physical storage constraints. Despite the recent agreement between OPEC+ countries and other oil producers to curb supply, it also highlights the continuing pressure on oil prices. In order to overcome this situation is, they might come up with new ideas to improve their export business. Otherwise, this subzero oil prices threaten huge losses for investors. Those who bet on crude recovery through exchange traded funds face high risks

ReplyDeleteMany important economic concepts here. Happy reading.

DeleteAs we can see the current situation right now where the price of oil keep on fallen about 60% from the normal prices starting from february due to the pandemic of Covid-19. Recently, the oil price is getting better as President of US stated that the manufacturers reducing the quantity of production around 20 million of barrel per day. West Texas Intermediate (WTI) US crude oil traded 2% higher at US $22.85, while Brent's international benchmark rose 1.5% to US $32.26. Saudi Arabia announced that it would raise prices on almost all oil classes for June, indicating the country wants to raise prices rather than dominate the market.

ReplyDeleteBy A'ishatul Imani

DeleteGood use of statistics. Keep it up.

DeleteIn 2019, the oil prices stayed approximately around $50. Due to the COVID-19 which causes a great lockdown all over the world, leading to a decrease in oil demand. The oil prices started to fall since February 2020 as China turning away oil tankers. In March 2020, the oil prices keep falling to below $25 due to OPEC+ talks collapse causes Russia to walk away from negotiations. Saudi Arabia suggested to cut the oil prices by $6 to $8 per barrel but Russia rejected. The oil prices dropped significantly in April 2020 when WHO declares the COVID-19 pandemic, until it going below zero ($0). Hence, WTI crude prices for April 2020 was sitting at -$38.45 per barrel, falling as high as 310.45% from previous year.

ReplyDeleteAs it become worse, many of the thinkers tend to store the oil, and wishing to resell it at higher price. As we can see in the info-graphic, The oil price expected to increase as much of 1.76% in September 2020 ($ 24.84 per barrel) from its spot price which $9 per barrel. Besides, to overcome the glut, OPEC and others decided to cut oil output of 9.7 million barrels per day which roughly about 10% of the demand. As the result, an oil price war ended.

Demand. Supply. Prices. Statistics. :)

DeleteIn my opinion, the oil prices will remain weak as it suddenly sunk below zero for the first time ecer due to Covid-19 pandemic. We can see that this issue happened aa to keeps people at home and destroys demand for transportation fuel.

ReplyDeleteThis issue is believed to happened because of the storage in Cushing, Oklahoma, is now full , which is the delivery point of West Texas Intermediate future contracts.That means the price of physical barrels has no choice, but to ve negative.

I have been to Texas, but not Oklahoma. Would be interesting to visit the oil storage location.

DeleteAs we can see the current situation,the oil price has fallen about 60% from February highs because when WHO declares covid-19 a pandemic so people should stay at home to overcome virus spreading and people cannot use oil as usual.the other factor is the war between Arab Saudi and Russia. in my opinion,the thinkers need to think how to use another things without use oil as usually

ReplyDeleteWhat do you suggest? Who are the thinkers?

ReplyDeleteMidtown Modern Prices Margaret Ville Condo by MCL. Hotline 61234567. New Launch Queenstown Condo in Singapore. Get Direct Developer VVIP Pricing, Floor Plan, Discounts & more.

ReplyDelete