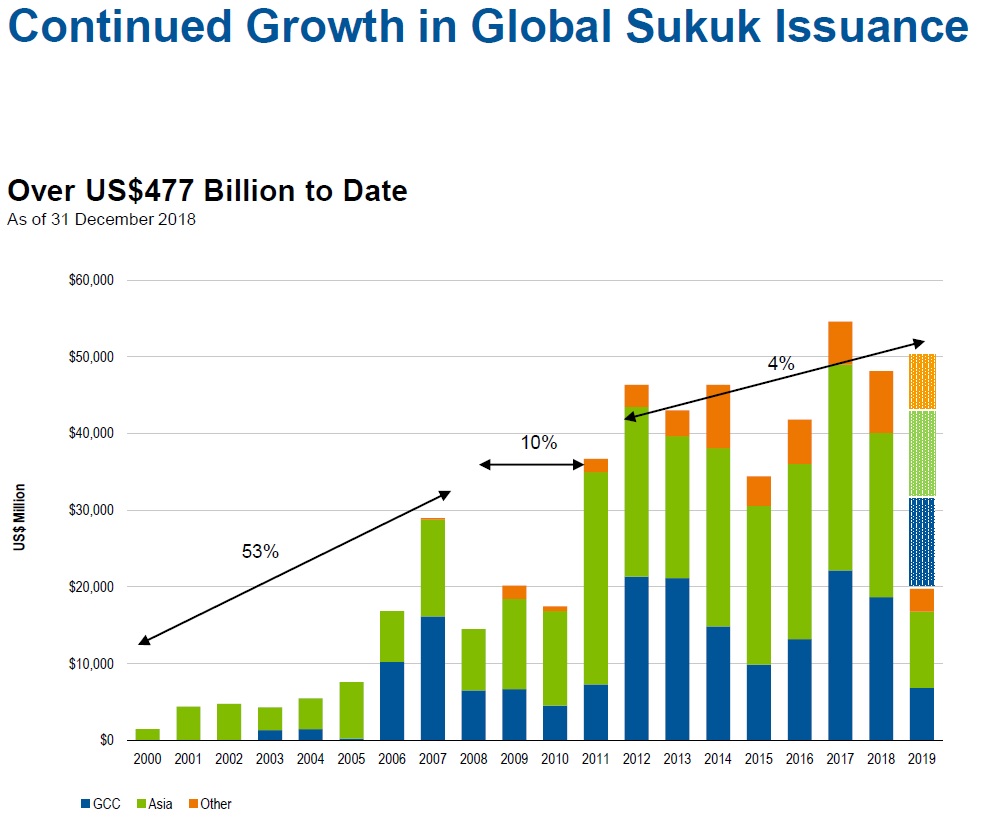

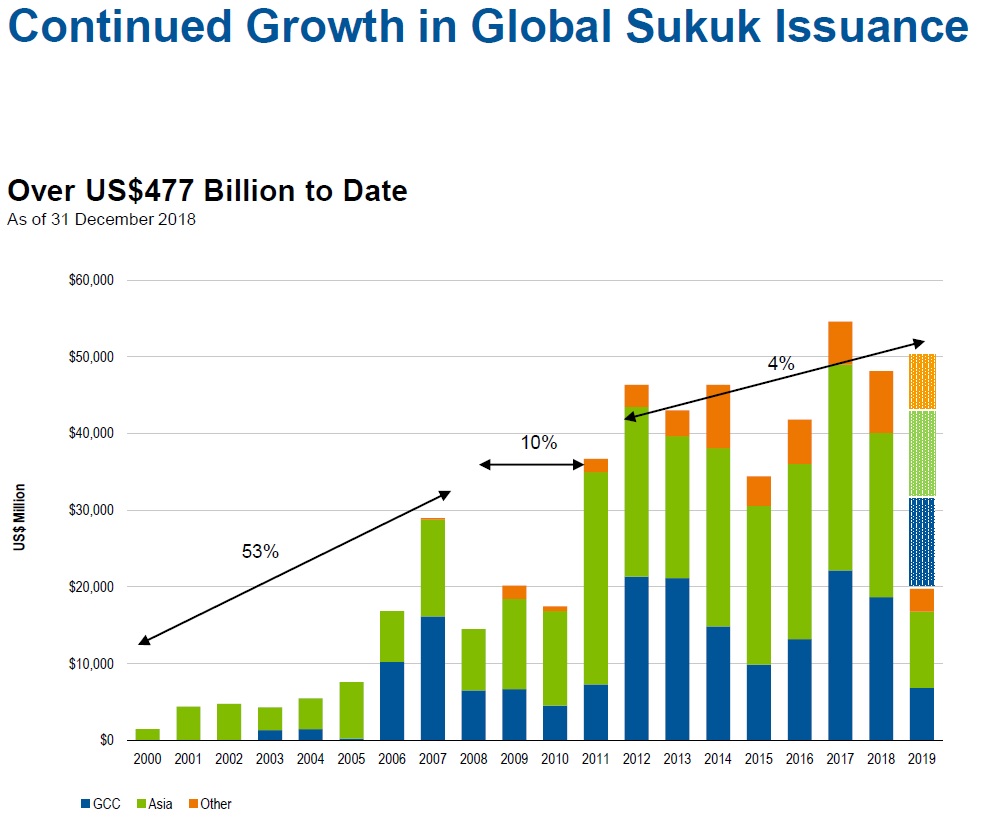

Back in 2017, I wrote a case study on Brexit. The prediction was Britain would issue Sukuk to maintain its position as the western hub for Islamic finance. Will Sukuk be both the game maker and game changer post-Brexit? An interesting development to watch.

Excerpt:

"LONDON: The British government has issued £500 million ($686.85 million) worth of Shariah-compliant sovereign bonds — seven years since it made history as the first country outside the Muslim world to issue a sovereign sukuk.

The Treasury said on Thursday that “£500 million of sukuk, the Islamic equivalent of a bond, has been sold to investors based in the UK and in the major hubs for Islamic finance in the Middle East and Asia.”

...He said: “They’re not doing it as a funding tool. They have other objectives in mind: They want to maintain their status as a Western hub for Islamic finance, including sukuk. London is one of the largest hubs for issuing sukuk, and this is more important in these times because of Brexit.”

He added: “Other countries, such as Ireland and Luxembourg, are eyeing the status of Islamic finance hub in the Western world — the UK is looking at it from this angle.”

Competition between these locations is already underway, said Al-Natoor. “Ireland is already working on their Islamic finance offering, and Luxembourg has very advanced infrastructure, mainly toward Islamic fund management. You have these two that are visible when it comes to Islamic finance,” he added. “The UK has a head start in the field, but is there competition? I think yes, there is.”

https://www.arabnews.com/node/1831956/business-economy

Image - Trade Finance Global